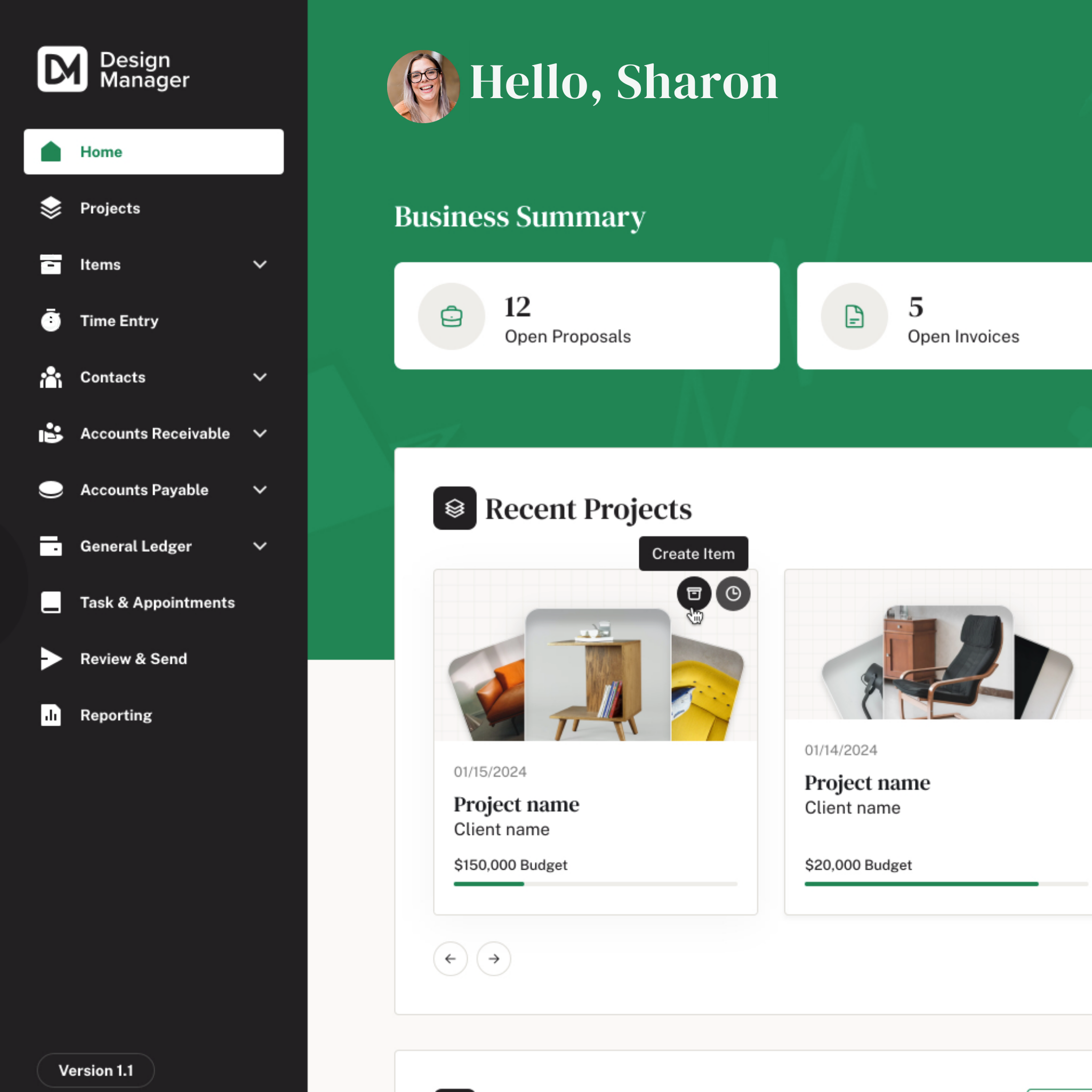

Design Manager Provides Peace of Mind for Business Owners. I love Design Manager because I don't have to think about it.

Design Manager keeps my team organized and running smoothly. It lets us focus on being creative rather than billing and project management.

I tried QuickBooks and it didn't fit her business so that's when she switched to industry-specific software, Design Manager.

Average rating of the app

Beta customers

Customer support

Be the first to know about releases and industry news and insights.